The U.S. dollar's share of global reserves fell to nearly 40% at the end of 2025, according to the International Monetary Fund (IMF), which says it's 10% lower than at the start of 2024. However, gold has risen and overtaken the dollar to be above 50% in global reserves according to the IMF data.

Gold is now considerably more valuable than any other currency.

The gradual decline in the U.S. dollar’s dominance as the world’s primary reserve currency started in 2022 after a small peak. This means that central banks and other global financial institutions are holding a small percentage of their foreign exchange in the dollar and investing in other assets, such as gold.

Early in 2022, the dollar strengthened as the Federal Reserve raised interest rates to combat inflation.

However, by late 2022 inflation showed signs of peaking and once investors anticipated that U.S. rates would stop rising faster than other currencies, the dollar lost its momentum.

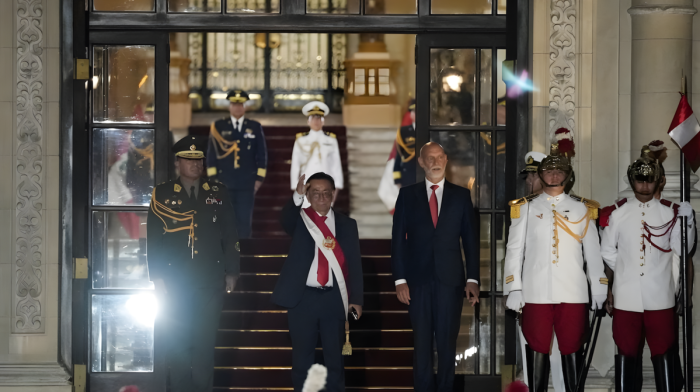

U.S. President Donal Trump said last July, “If we lost the world standard dollar, that would be like losing a war. We would not be the same country.”

One of the primary drivers of the dollar’s declining role is the weaponisation of U.S. sanctions and asset freezes. These measures have encouraged other countries and even some U.S. partners to seek alternatives to reduce vulnerability to political pressure.

As a result, countries have increased bilateral trade in local currencies and explored non-dollar settlement mechanisms.

The BRICS nations of Brazil, Russia, India, China and South Africa have actively sought to reduce its reliance on the U.S. dollar by shifting trade settlements to local currencies.

By the end of the second quarter of last year, the share of global currency reserves held in the dollar was 57.08%, while the share of euros gained, rising to 20.33% from 20.24% quarter-on-quarter, the IMF's Currency Composition of Official Foreign Exchange Reserves data showed last December.

It also showed the share of reserves held in the Japanese yen increased to 5.82% in the third quarter from 5.65% in the second quarter.

"For both dollar and euro reserves, our FX valuation adjustment suggests that reserve managers leaned into currency market fluctuations," Goldman Sachs analysts said on the data.

"Q3 saw a stabilisation in reported reserves with only minimal shifts in the share of USD and EUR reserves following large swings in reported reserves in Q2."

Those swings in 2025 have spurred a debate on whether the U.S. dollar could lose its status as the world's reserve currency of choice and the centre point of the global monetary system.

Some analysts point to nascent signs of de-dollarisation, but there is broad agreement that any such shift would be very slow.

The role of the dollar could now have a significant impact on the U.S. economy, including potentially higher borrowing costs.

Investors have struggled to get an accurate read of the world's largest economy following a record U.S. government shutdown last year which hampered the collection and release of key economic data. However, they remain convinced that the Fed will cut rates at least two more times this year.

Even though the dollar’s share has gradually decreased over the last decades it remains the single most dominant currency globally.

What is your opinion on this topic?

Leave the first comment