Pakistan strikes targets in Afghan cities as minister brands it 'open war'

Pakistani air strikes hit a weapons depot on the western outskirts of Kabul overnight, triggering hours of secondary explosions that rattled homes acr...

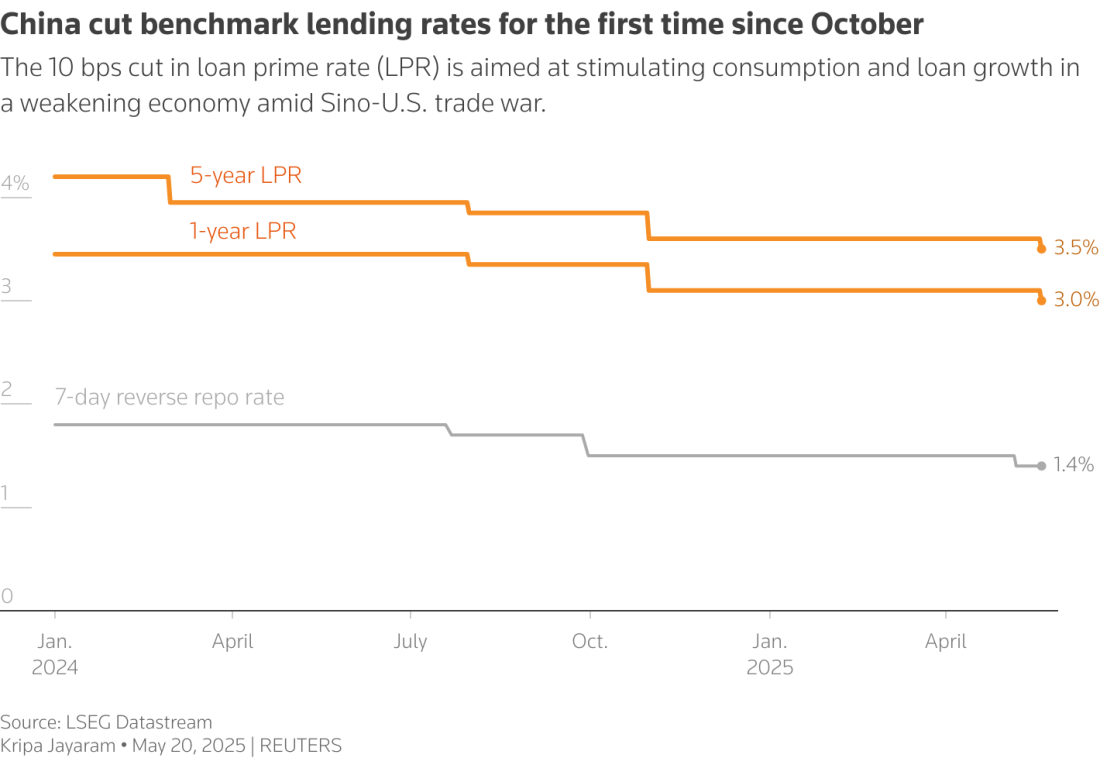

China cut benchmark lending rates for the first time since October on Tuesday, while major state banks lowered deposit rates as authorities work to ease monetary policy to help buffer the economy from the impact of the Sino-U.S. trade war.

The widely expected rate cuts are aimed at stimulating consumption and loan growth as the world's No. 2 economy softens, while still protecting commercial lenders' shrinking profit margins.

Still, the size of the rate reductions was mild and reflected the incremental pace of monetary easing in recent years and what analysts interpreted as some wariness among policymakers for more aggressive steps while they navigate the trade war with the United States.

The People's Bank of China said the one-year loan prime rate (LPR), a benchmark determined by banks, had been lowered by 10 basis points to 3.0% , while the five-year LPR was reduced by the same margin to 3.5%.

Most new and outstanding loans in China are based on the one-year LPR, while the five-year rate influences the pricing of mortgages. Both rates are now at the lowest level since China ravamped the LPR mechanism in 2019.

The lending rate cut was announced just after five of China's biggest state-owned banks said they had trimmed their deposit interest rates.

Industrial and Commercial Bank of China (601398.SS), opens new tab, Agricultural Bank of China (601288.SS), China Construction Bank (601939.SS), and Bank of China (601988.SS) reduced deposit rates by 5-25 basis points (bps) for some tenors, according to rates shown on the banks' mobile apps. Reuters had reported on Monday that the banks planned to cut their deposit rates from Tuesday.

The deposit rate reductions should guide smaller lenders in making similar cuts.

Banking shares edged higher following the rate decision, with the CSI Bank Index (.CSI399986) rising 0.3%.

Marco Sun, chief financial market analyst at MUFG Bank (China), said the rate cuts were aimed at boosting credit lending and stimulating consumption.

The death toll from heavy rains and flooding in Brazil’s Minas Gerais state has risen to 46, authorities said, with 21 people still reported missing. The storms triggered landslides and widespread flooding, displacing thousands across Juiz de Fora and Uba.

The situation in Cuba was heating up and called for restraint following a deadly incident involving a Florida-registered speedboat off the coast of the Caribbean island, the Kremlin said on Thursday (26 February).

Syria’s economy is showing clear signs of recovery, with economic activity accelerating in recent months, the International Monetary Fund (IMF) said on Wednesday.

The United States has deployed the aircraft carrier USS Gerald R. Ford near Israel as part of a growing military build-up amid tensions with Iran, while governments around the world urge their citizens to leave parts of the region.

Pakistani air strikes hit a weapons depot on the western outskirts of Kabul overnight, triggering hours of secondary explosions that rattled homes across the Afghan capital and left residents fearing further violence.

Paramount Skydance emerged as the winner in a months-long battle to acquire Warner Bros Discovery after streaming giant Netflix on Thursday refused to raise its bid for the storied Hollywood studio.

Global debt surged to a record $348.3 trillion at the end of 2025, after nearly $29 trillion was added over the year, marking the fastest annual increase since the pandemic, according to the Institute of International Finance (IIF) report released on Wednesday.

Millions of Colombian roses have arrived in the United States just in time for Valentine’s Day, keeping the country on track as the world’s second-largest flower exporter. Between 15 January and 9 February, Colombia shipped roughly 65,000 tons of fresh-cut blooms.

Russia’s car market is continuing to receive tens of thousands of foreign-brand vehicles via China despite sanctions imposed after Moscow’s full-scale invasion of Ukraine in 2022, a journalistic investigation has found.

Türkiye’s national energy company, TPAO, has struck a new cooperation deal with U.S. energy giant Chevron, signing a memorandum of understanding to explore joint oil and gas exploration and production opportunities, the Turkish Energy and Natural Resources Ministry announced on Thursday.

You can download the AnewZ application from Play Store and the App Store.

What is your opinion on this topic?

Leave the first comment