Iran ramps up diplomatic action as UN Security Council vote looms

On the eve of the United Nations Security Council meeting on Friday to vote on a six-month extension of Iran’s nuclear sanctions under Resolution 22...

The relationship between OpenAI and NVIDIA represents one of the most consequential partnerships in the artificial intelligence (AI) industry, a symbiotic alliance that has evolved from humble beginnings to a £73 billion strategic collaboration that could reshape the future of computing.

Yet beneath the surface of their September 2025 landmark agreement lies a complex narrative of mutual dependence, strategic hedging, and the relentless pursuit of technological sovereignty in an era where artificial intelligence has become the new battleground for global economic supremacy.

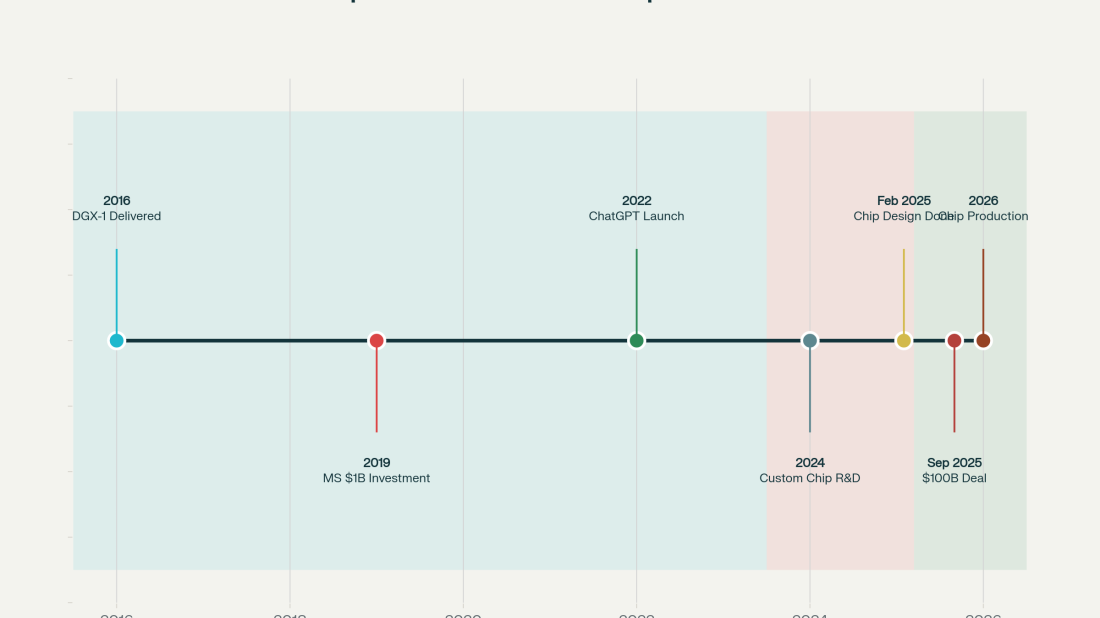

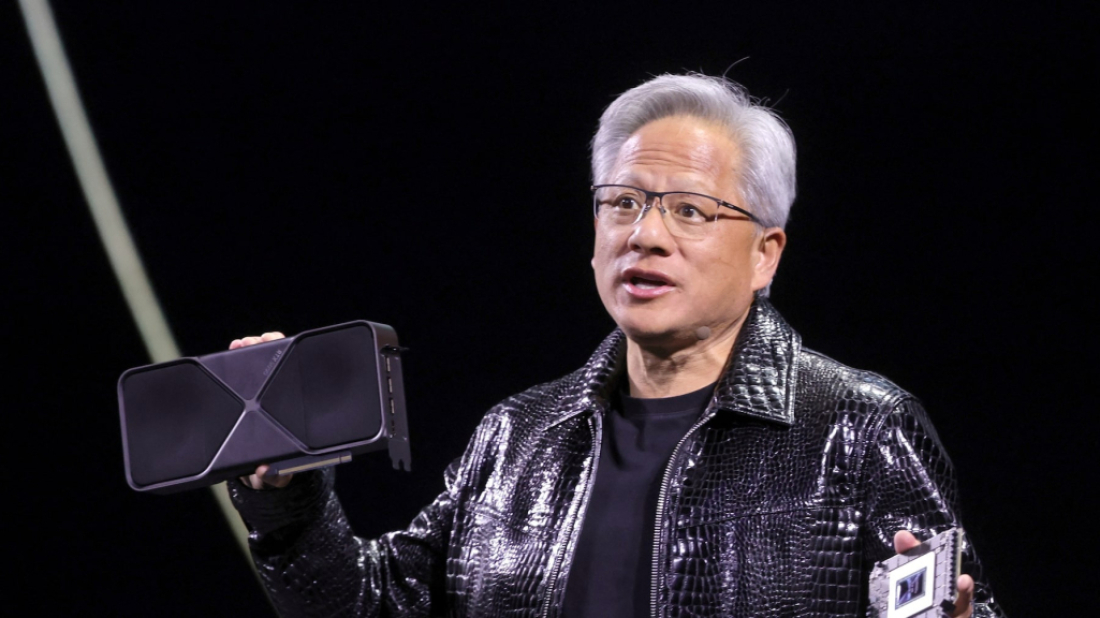

The story begins in 2016, when NVIDIA's founder and chief executive Jensen Huang personally delivered the company's first DGX-1 supercomputer to OpenAI's modest San Francisco headquarters. This symbolic gesture marked the beginning of what would become one of technology's most significant partnerships, yet it also foreshadowed the tensions that would later emerge as both companies grew into industry titans with overlapping ambitions.

The Foundation of a Revolutionary Partnership

The early relationship between OpenAI and NVIDIA was built on mutual necessity rather than mere convenience. OpenAI, founded as a nonprofit research laboratory dedicated to ensuring artificial general intelligence benefits humanity, required enormous computational power to train increasingly sophisticated models. NVIDIA, meanwhile, was transitioning from its origins as a graphics chip manufacturer into the backbone of the artificial intelligence revolution.

The DGX-1 delivery in 2016 represented more than a hardware transaction—it was the physical manifestation of a shared vision for AI's potential. As Greg Brockman, OpenAI's co-founder and president, would later reflect.

"We've been working closely with NVIDIA since the early days of OpenAI. We've utilised their platform to create AI systems that hundreds of millions of people use every day," Brockman said.

This partnership proved prescient. When OpenAI launched ChatGPT in November 2022, the system that would capture global imagination and trigger the current AI boom was powered entirely by NVIDIA's infrastructure.

The success of ChatGPT validated both companies' strategies: OpenAI had created a transformative AI application, whilst NVIDIA had positioned itself as the indispensable supplier of the computational foundation that made such breakthroughs possible.

The financial implications were staggering. NVIDIA's data centre revenue surged from modest levels to more than £115 billion in fiscal 2025, representing a 142% increase year-over-year.

The company's market capitalisation reached £3.3 trillion, briefly surpassing both Apple and Microsoft as the world's most valuable company. OpenAI, for its part, grew from a small research organisation to a company valued at £400 billion, serving more than 700 million weekly active users.

The Era of Mutual Dependence

The relationship between 2019 and 2024 can be characterised as one of increasingly profound mutual dependence. Microsoft's initial £800 million investment in OpenAI, followed by an additional £8 billion in 2023, cemented a three-way partnership where OpenAI's models ran on Microsoft's Azure cloud platform, which in turn relied heavily on NVIDIA's GPUs.

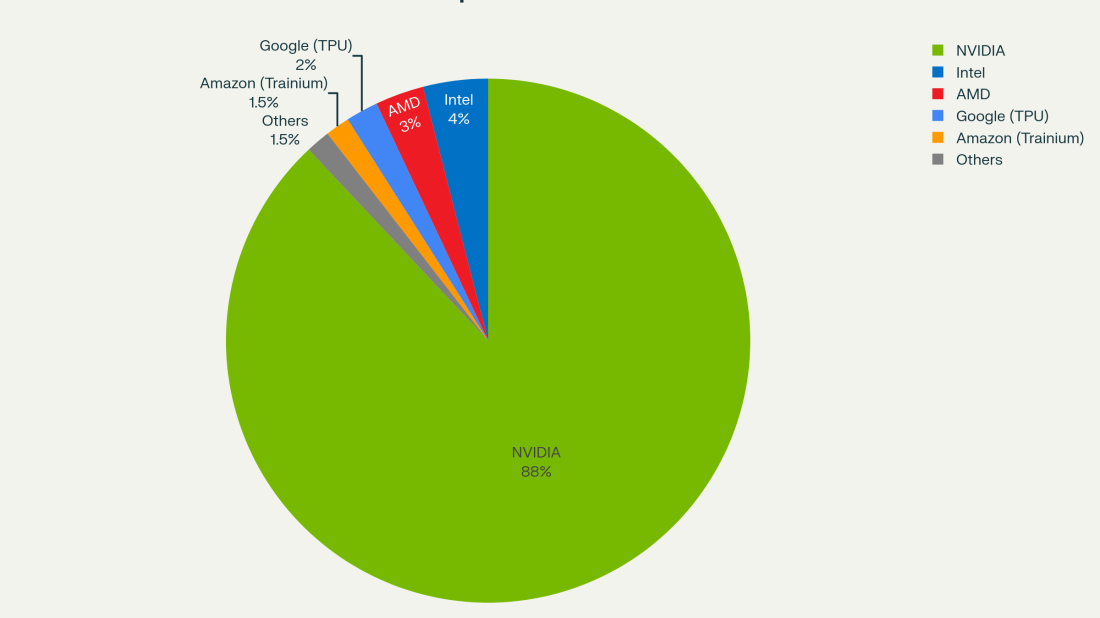

This period saw NVIDIA achieve near-monopolistic control over the AI chip market, with estimates suggesting the company held between 80% and 95% of the market for AI accelerators by 2024. The concentration was even more pronounced in advanced AI training chips, where NVIDIA's H100 and subsequent B100 processors became the gold standard for training large language models.

For OpenAI, this dependence came with significant costs and constraints. CEO Sam Altman frequently complained about GPU shortages, writing on social media that the company was "out of GPUs" and needed to add "tens of thousands" more to roll out new features.

The financial burden was equally severe, with training costs for models like GPT-4 estimated in the hundreds of millions of pounds, much of which flowed directly to NVIDIA through hardware procurement and cloud computing costs.

The First Cracks: Custom Silicon and Strategic Diversification

By 2024, signs of strain began to emerge in the OpenAI-NVIDIA relationship. Like other technology giants including Google, Amazon, and Meta, OpenAI began exploring the development of custom silicon designed specifically for its AI workloads.

The initiative, led by former Google AI chip expert Richard Ho, represented a direct challenge to NVIDIA's dominance and OpenAI's first serious attempt to reduce its dependence on external suppliers.

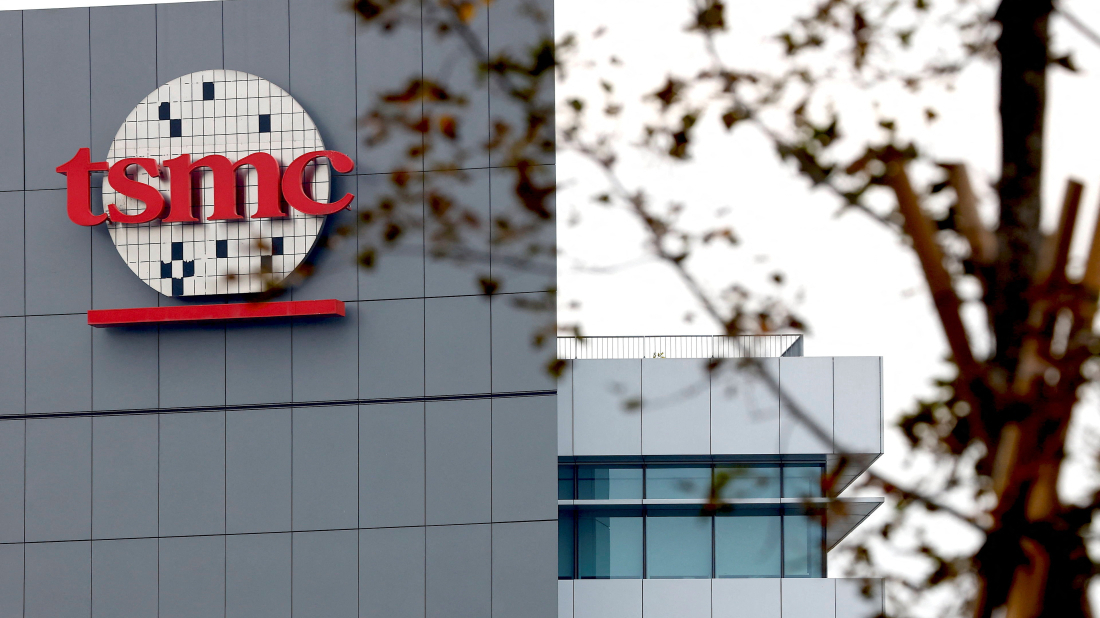

The custom chip project, partnering with Broadcom for design and Taiwan Semiconductor Manufacturing Company (TSMC) for fabrication, was explicitly aimed at reducing OpenAI's reliance on NVIDIA while providing greater control over costs and supply chains.

Reports suggested the initiative could save OpenAI billions of pounds annually whilst providing performance optimisations tailored specifically to its models and inference workloads.

This move was part of a broader industry trend. Google's Tensor Processing Units (TPUs) had already demonstrated the viability of custom AI chips, whilst Amazon's Trainium processors were beginning to offer compelling alternatives to NVIDIA's GPUs for specific workloads. Even Microsoft began developing its own AI chips as part of its strategy to reduce dependence on NVIDIA.

The development was not lost on NVIDIA's leadership. Jensen Huang had long recognised that his company's customers would eventually seek to reduce their dependence on external suppliers.

"The most successful companies in the world are vertically integrated," he observed, acknowledging the inevitability of this trend whilst positioning NVIDIA to remain relevant through superior technology and ecosystem integration.

The Broader Competitive Landscape

OpenAI's chip ambitions emerged against a backdrop of intensifying competition in the AI hardware space. Google's TPU programme had matured significantly, with the company's seventh-generation Trillium chips delivering 4.7 times the performance of previous generations whilst consuming 67% less energy. Amazon's Trainium2 processors were offering 30-40% better price performance than comparable GPU-based instances, positioning AWS as a formidable competitor for AI training workloads.

Perhaps more concerning for NVIDIA was the growing sophistication of these alternatives. OpenAI had reportedly begun testing Google's TPUs for some workloads, marking the first significant use of non-NVIDIA chips in the company's infrastructure. Whilst these experiments were limited in scope, they represented a meaningful diversification away from NVIDIA's dominance.

The geopolitical dimension added another layer of complexity. U.S. export controls on advanced AI chips to China had constrained global supply whilst spurring domestic innovation in Chinese companies such as Huawei and Cambricon. This fragmentation of the global semiconductor market created both opportunities and risks for all players, as supply chains became increasingly politicised and national security considerations influenced commercial decisions.

The September 2025 Détente: A Landmark Partnership

Against this backdrop of growing competition and diversification efforts, the September 2025 announcement of a £73 billion strategic partnership between OpenAI and NVIDIA came as something of a surprise to industry observers.

The deal, negotiated directly between Altman and Huang without the involvement of investment banks, represented a dramatic escalation of their collaboration just as many expected the relationship to fracture.

Under the agreement, NVIDIA committed to investing up to £73 billion in OpenAI over several years, tied to the deployment of at least 10 gigawatts of AI infrastructure—equivalent to the power consumption of approximately 8 million British households. The first phase, targeted for the second half of 2026, would utilise NVIDIA's forthcoming Vera Rubin platform and represent the largest AI infrastructure deployment in history.

The financial structure was designed to benefit both parties whilst avoiding the "circular investment" concerns that had plagued previous arrangements. NVIDIA would invest £7.3 billion at a time as each gigawatt of capacity came online, with OpenAI using these funds to purchase NVIDIA's systems. This arrangement provided OpenAI with the capital needed for expansion whilst ensuring NVIDIA a guaranteed customer for its most advanced products.

"Everything starts with compute," Altman explained during the announcement.

"Compute infrastructure will be the basis for the economy of the future, and we will utilise what we're building with NVIDIA to both create new AI breakthroughs and empower people and businesses with them at scale," Altman said.

For Huang, the partnership represented validation of NVIDIA's strategy to position itself not merely as a chip supplier but as an essential partner in the AI ecosystem.

"NVIDIA and OpenAI have pushed each other for a decade, from the first DGX supercomputer to the breakthrough of ChatGPT," he noted.

"This investment and infrastructure partnership mark the next leap forward—deploying 10 gigawatts to power the next era of intelligence," Huang added.

Strategic Implications and Market Dynamics

The September 2025 partnership announcement triggered immediate reactions across financial markets, with NVIDIA's stock price rising 4% on the news whilst other AI infrastructure companies also saw gains. However, the deal's implications extend far beyond immediate stock movements, representing a fundamental realignment of power dynamics in the AI industry.

For NVIDIA, the partnership provides crucial revenue visibility and customer commitment at a time when competition in AI chips is intensifying. The guaranteed orders from OpenAI help justify continued investment in research and development whilst providing a stable foundation for planning next-generation architectures.

The deal also addresses one of NVIDIA's key strategic vulnerabilities: the risk that major customers would successfully develop alternative chips and reduce their dependence on NVIDIA's products. By deepening its partnership with OpenAI through both investment and preferential access to cutting-edge technology, NVIDIA has created additional switching costs that make it more difficult for OpenAI to migrate away from its ecosystem.

For OpenAI, the partnership provides access to unprecedented computational resources whilst maintaining strategic optionality. Despite naming NVIDIA as a "preferred" partner, company executives emphasised that the arrangement is not exclusive and that OpenAI continues to work with multiple suppliers including Microsoft, Oracle, and SoftBank through the Stargate project.

This multi-vendor strategy reflects OpenAI's recognition that no single supplier, regardless of technological leadership, should be allowed to become a single point of failure for its operations. The company's parallel development of custom chips with Broadcom and TSMC continues, with mass production still targeted for 2026.

The Persistence of Competitive Tensions

Despite the fanfare surrounding the September partnership announcement, fundamental competitive tensions between OpenAI and NVIDIA remain unresolved. OpenAI's custom chip programme continues to advance, with reports suggesting that the first silicon could begin production within months. The chips, internally referred to as "XPUs," are designed specifically for inference workloads—running AI models rather than training them—and could provide significant cost savings for OpenAI's operations.

The timing is significant. By 2026, when OpenAI's custom chips enter mass production, the company will have both unprecedented access to NVIDIA's most advanced systems through their partnership and the option to gradually migrate certain workloads to its own silicon. This dual-track approach provides OpenAI with maximum strategic flexibility whilst hedging against supply chain disruptions or pricing pressures from any single vendor.

Industry analysts suggest this arrangement may actually represent the optimal outcome for both companies. NVIDIA secures a major customer and investment opportunity whilst avoiding a complete rupture that might have accelerated OpenAI's migration to alternative suppliers. OpenAI gains access to cutting-edge technology and significant capital investment whilst maintaining its strategic autonomy through custom chip development.

Broader Industry Implications

The OpenAI-NVIDIA partnership has important implications for the broader technology industry and the future of artificial intelligence development. The scale of the investment—£73 billion over several years—dwarfs most national AI initiatives and underscores the massive capital requirements for advancing the frontiers of artificial intelligence.

The deal also highlights the increasing concentration of AI capabilities among a small number of companies with access to vast computational resources. OpenAI's ability to secure such substantial infrastructure investment provides significant competitive advantages over smaller AI companies that lack similar access to capital and computing power.

From a geopolitical perspective, the partnership reinforces the dominance of U.S.-based companies in global AI leadership whilst highlighting the critical importance of semiconductor supply chains. The involvement of TSMC in both NVIDIA's chip production and OpenAI's custom silicon development underscores Taiwan's pivotal role in the global AI ecosystem.

The relationship between OpenAI and NVIDIA also illustrates the complex interdependencies that characterise the modern technology industry. Despite their parallel development of potentially competing products, both companies recognise their mutual interest in advancing AI capabilities and maintaining technological leadership against international competitors.

Looking Toward the Future

As the AI industry continues to mature, the relationship between OpenAI and NVIDIA will likely serve as a template for how technology giants navigate the tension between cooperation and competition. The September 2025 partnership represents neither a complete merger of interests nor a fundamental resolution of competitive tensions, but rather a sophisticated arrangement that allows both companies to pursue their strategic objectives whilst maintaining operational flexibility.

The success of this model will depend on several factors. OpenAI must successfully execute its custom chip programme whilst continuing to leverage NVIDIA's technological leadership for its most demanding workloads. NVIDIA must continue to innovate at a pace that justifies its premium pricing whilst adapting to a world where major customers increasingly develop their own silicon alternatives.

Perhaps most importantly, both companies must navigate the broader competitive landscape that includes not only each other but also technology giants such as Google, Amazon, and Microsoft, each pursuing their own AI ambitions with substantial resources and strategic focus. The ultimate test of the OpenAI-NVIDIA partnership will be whether it enhances both companies' competitive positions in this broader contest for AI supremacy.

The relationship between OpenAI and NVIDIA thus represents more than a business partnership—it embodies the complex dynamics that will shape the future of artificial intelligence and determine which companies, and which nations, will lead in the technologies that increasingly define economic and strategic power in the 21st century. As both companies continue to push the boundaries of what artificial intelligence can achieve, their evolving relationship will remain one of the most closely watched partnerships in the technology industry.

AnewZ has learned that India has once again blocked Azerbaijan’s application for full membership in the Shanghai Cooperation Organisation, while Pakistan’s recent decision to consider diplomatic relations with Armenia has been coordinated with Baku as part of Azerbaijan’s peace agenda.

A day of mourning has been declared in Portugal to pay respect to victims who lost their lives in the Lisbon Funicular crash which happened on Wednesday evening.

A Polish Air Force pilot was killed on Thursday when an F-16 fighter jet crashed during a training flight ahead of the 2025 Radom International Air Show.

Video from the USGS (United States Geological Survey) showed on Friday (19 September) the Kilauea volcano in Hawaii erupting and spewing lava.

At least eight people have died and more than 90 others were injured following a catastrophic gas tanker explosion on a major highway in Mexico City’s Iztapalapa district on Wednesday, authorities confirmed.

Miniso announced on Friday that it will spin off its brand Top Toy and list it in Hong Kong, capitalising on the growing investor interest in Chinese toymakers and highlighting the city’s renewed position as a global fundraising hub.

The U.S. envoy to Türkiye has confirmed that a Turkish Airlines’ Boeing aircraft deal has been finalised, marking a significant step in expanding the carrier’s fleet.

Since the end of 2024, the price of cocoa has fallen below $7,000 per tonne, as expectations of increased supply and weakening demand triggered a sharp market decline.

Broad market stocks experienced slight declines during the day, according to Alexander Morris, CEO and Chief Investment Officer of F/M Investments.

Alibaba (9988.HK) announced on Wednesday a wide-ranging push into artificial intelligence (AI), unveiling a partnership with Nvidia, a global data centre expansion plan, and new AI products, as it seeks to make artificial intelligence a core business priority alongside its e-commerce operations.

You can download the AnewZ application from Play Store and the App Store.

What is your opinion on this topic?

Leave the first comment