live Iran’s Supreme Leader Ayatollah Ali Khamenei is dead, state media confirms

Follow the latest developments and global reaction after the U.S. and Israel launched “major combat operations” in Iran, prompting reta...

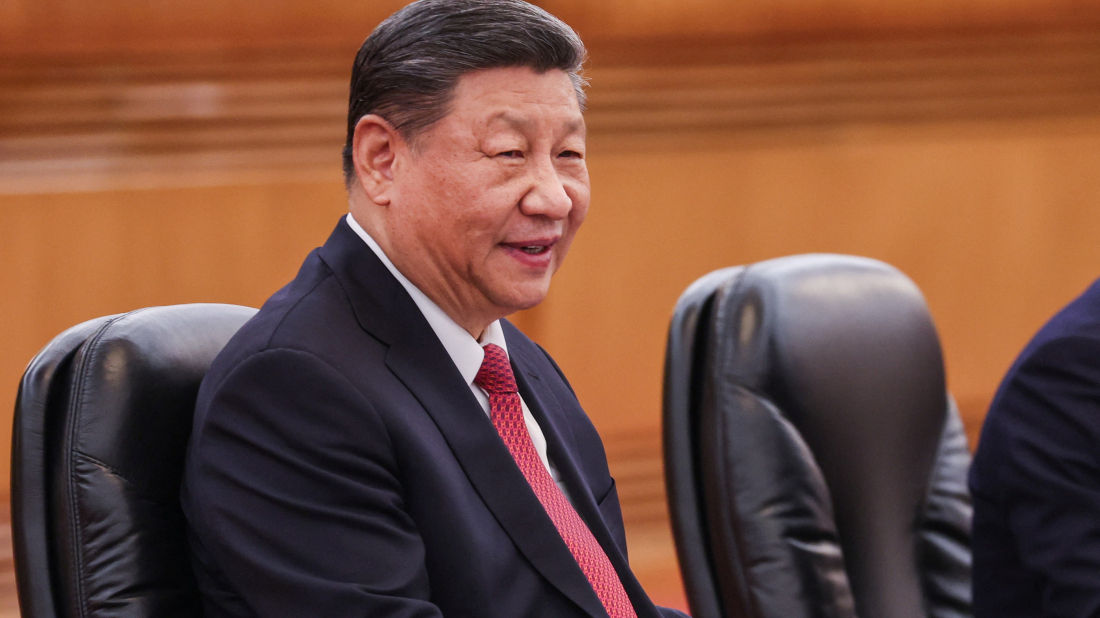

Beijing, Feb 17 (Reuters) — Chinese President Xi Jinping met with some of the country’s most prominent technology leaders on Monday, urging them to embrace innovation and reaffirming Beijing’s support for private enterprise.

The rare gathering, held at the Great Hall of the People, comes as China faces mounting economic pressures and intensifying competition with the United States in the tech sector.

Xi’s message marked a significant shift from Beijing’s regulatory crackdown on tech firms over the past four years. Analysts see the move as an acknowledgment that China needs its private sector to compete globally, particularly in artificial intelligence (AI) and semiconductor development, areas where U.S. restrictions have sought to curb Beijing’s progress.

A call for confidence in China’s model

Xi’s remarks, summarized by state media, emphasized that China’s private sector has “broad prospects and great promise” to drive technological and economic progress. "It is the right time for the majority of private businesses and entrepreneurs to show their talent," he said.

The meeting included high-profile figures such as Alibaba founder Jack Ma, Huawei’s Ren Zhengfei, and BYD’s Wang Chuanfu, reflecting a strategic alignment between China’s leadership and its most influential business figures. Ma’s presence was particularly notable, as he had largely retreated from public life following Beijing’s crackdown on Alibaba and the suspension of Ant Group’s IPO in 2020.

U.S.- China tech rivalry and economic pressures

China’s outreach to business leaders comes amid growing challenges. The country is grappling with weak domestic consumption, a real estate debt crisis, and U.S. trade restrictions on advanced semiconductor technology. Washington’s latest tariffs and export bans have made it harder for China to acquire cutting-edge chips, prompting Beijing to accelerate self-sufficiency efforts.

Christopher Beddor, deputy China research director at Gavekal Dragonomics, noted that Xi’s meeting signaled a recalibration of policy. “It’s a tacit acknowledgment that the Chinese government needs private-sector firms for its tech rivalry with the United States,” he said.

China’s private sector accounts for more than 60% of GDP, over 50% of tax revenues, and around 70% of technological innovation, according to government data.

DeepSeek and china’s ‘Sputnik Moment’ in AI

Among the attendees was Liang Wenfeng, founder of DeepSeek, a Chinese AI startup that has been described as a potential disruptor in the global AI landscape. DeepSeek’s lower-cost AI model has drawn comparisons to a "Sputnik moment" for China, as it signals the country’s push to close the gap with U.S. firms like OpenAI and Nvidia.

The AI breakthrough has fueled optimism in China’s tech industry. The Hang Seng technology index (.HSTECH) reached a three-year high during morning trade on Monday before closing slightly lower.

Who was in and who was out?

The attendance list provided insight into Beijing’s evolving relationship with the private sector. Executives from Tencent, Meituan, CATL, and Will Semiconductor were present. However, notable absences included top executives from Baidu and ByteDance, raising speculation about their standing with the government. Baidu’s shares fell over 8% on the Hang Seng index following the event.

‘Injecting Confidence’ in the private sector

Monday’s meeting was reminiscent of Xi’s 2018 gathering with business leaders during the U.S.-China trade war, when he promised tax cuts and greater financial access to private firms. Analysts see this latest meeting as a bid to reassure China’s entrepreneurs that their role remains central to the nation’s economic strategy.

“The purpose is to tell them, ‘We want to support you. We need you to boost innovation and consumption,’” said Xiaoyan Zhang, a finance professor at Tsinghua University.

With the U.S. tightening restrictions on China’s tech sector, Beijing appears to be doubling down on its domestic champions. The coming months will reveal whether this renewed engagement translates into concrete policy changes that ease regulatory pressures and foster greater private-sector growth.

Follow the latest developments and global reaction after the U.S. and Israel launched “major combat operations” in Iran, prompting retaliation from Tehran.

Tensions between the U.S. and Iran are escalating, with Washington ordering a significant military build-up in the region and multiple countries evacuating diplomatic staff amid fears of further instability.

Two people were killed and around 40 injured when a tram derailed in central Milan on Friday (27 February), a spokesperson for the local fire service said.

Governments across the region responded swiftly to Israel’s strikes on Iran, closing airspace, issuing travel advisories and activating contingency plans amid fears of escalation.

Pakistani air strikes hit a weapons depot on the western outskirts of Kabul overnight, triggering hours of secondary explosions that rattled homes across the Afghan capital and left residents fearing further violence.

Paramount Skydance emerged as the winner in a months-long battle to acquire Warner Bros Discovery after streaming giant Netflix on Thursday refused to raise its bid for the storied Hollywood studio.

Global debt surged to a record $348.3 trillion at the end of 2025, after nearly $29 trillion was added over the year, marking the fastest annual increase since the pandemic, according to the Institute of International Finance (IIF) report released on Wednesday.

Millions of Colombian roses have arrived in the United States just in time for Valentine’s Day, keeping the country on track as the world’s second-largest flower exporter. Between 15 January and 9 February, Colombia shipped roughly 65,000 tons of fresh-cut blooms.

Russia’s car market is continuing to receive tens of thousands of foreign-brand vehicles via China despite sanctions imposed after Moscow’s full-scale invasion of Ukraine in 2022, a journalistic investigation has found.

Türkiye’s national energy company, TPAO, has struck a new cooperation deal with U.S. energy giant Chevron, signing a memorandum of understanding to explore joint oil and gas exploration and production opportunities, the Turkish Energy and Natural Resources Ministry announced on Thursday.

You can download the AnewZ application from Play Store and the App Store.

What is your opinion on this topic?

Leave the first comment