Israel defends Somaliland recognition as UN raises Gaza concerns

Israel has defended its recognition of Somaliland as an independent state, as several countries at the United Nations questioned whether the move coul...

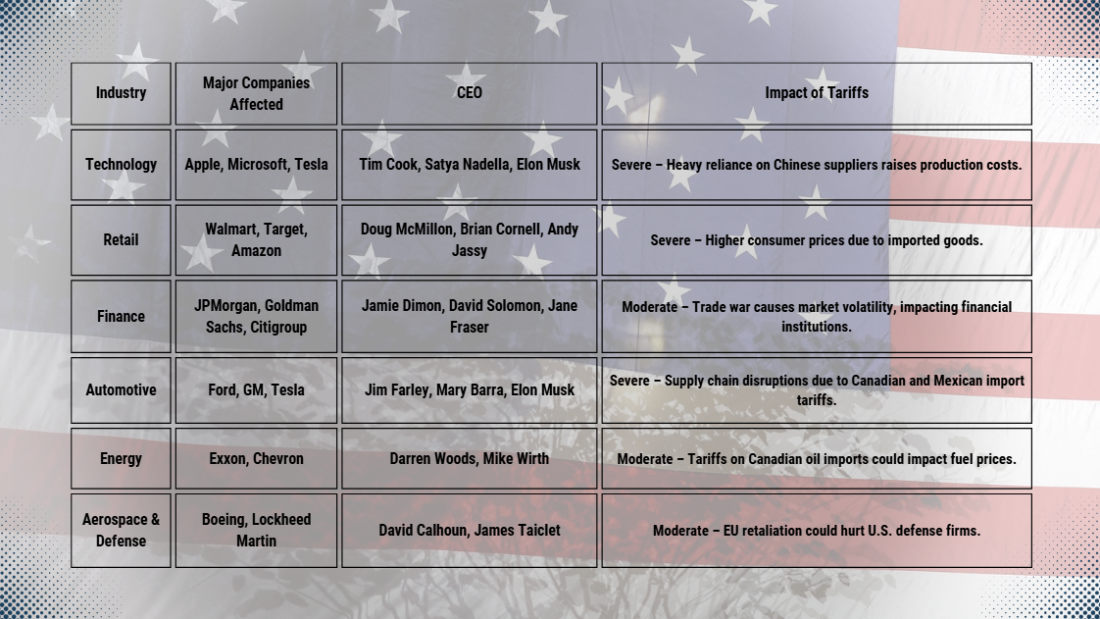

Donald Trump’s tariff threats on Canada, Mexico, and China unsettle U.S. firms, raising costs and supply risks. Many affected companies are led by Democratic-leaning executives, fuelling political tensions.

U.S. President Donald Trump has warned of sweeping 25% tariffs on Canada and Mexico and 10% duties on China, with potential action against the EU. The move, framed as a crackdown on trade imbalances and national security risks, has left industries on edge, with business leaders calling for de-escalation.

While the tariffs are temporarily paused for 30 days for Mexico, uncertainty looms over businesses heavily reliant on international trade. Key sectors facing disruption include technology, retail, energy, finance, and manufacturing.

Trump’s tariffs disproportionately impact industries led by Democratic donors, particularly technology and retail:

✅ Tim Cook (Apple) – Apple relies on China for production, making tariffs a major threat.

✅ Satya Nadella (Microsoft) – A proponent of free trade, opposed Trump’s tariffs on Chinese imports.

✅ Doug McMillon (Walmart), Brian Cornell (Target) – Large retailers relying on imported goods will see higher costs.

✅ Jamie Dimon (JPMorgan) – Wall Street is wary of trade instability affecting global markets.

🟥 Right-Leaning CEOs (Republican Supporters) – Hurt, but Less So

✅ Elon Musk (Tesla) – Has expressed past support for Trump but opposes tariffs due to China’s key role in Tesla’s market.

✅ Darren Woods (Exxon), Mike Wirth (Chevron) – Oil industry could take a hit, but domestic fracking firms may gain.

✅ David Calhoun (Boeing), James Taiclet (Lockheed Martin) – If the EU retaliates, the defense sector could be affected.

🔹 Technology & Retail (Democratic-leaning sectors) are most vulnerable as they rely heavily on global supply chains.

🔹 Energy & Defense (Republican-leaning industries) will feel the impact but have domestic alternatives.

🔹 The month-long pause on Mexico tariffs temporarily eases pressure on automakers and energy firms, but China tariffs still threaten tech and retail.

With potential EU tariffs looming, Trump’s trade war is widening economic and political divides, intensifying uncertainty for U.S. businesses.

A 7.0 magnitude earthquake struck offshore near Taiwan’s north-eastern county of Yilan late on Saturday, shaking buildings across the island, including in the capital Taipei, authorities said.

Brigitte Bardot, the French actress whose barefoot mambo in And God Created Woman propelled her to international fame and reshaped female sexuality on screen, has died at the age of 91, her foundation said on Sunday.

Japan’s tourism sector has experienced a slowdown after China’s government advised its citizens to reconsider travel to Japan, following remarks by Prime Minister Sanae Takaichi regarding Taiwan.

Venezuelan President Nicolás Maduro on Sunday praised the country’s armed forces as “invincible warriors” during a year-end ceremony honouring the Bolivarian National Armed Forces, held in the coastal city of La Guaira.

Roman Abramovich, the Russian billionaire and former Chelsea Football Club owner, has assembled a “top tier” legal team, including a former White House advisor, as he prepares for a legal battle in Jersey.

Israel has defended its recognition of Somaliland as an independent state, as several countries at the United Nations questioned whether the move could be linked to plans to relocate Palestinians from Gaza or establish Israeli military bases.

Russia accused Ukraine of trying to attack President Vladimir Putin’s residence on Monday, an allegation dismissed by President Volodymyr Zelenskyy as a “complete fabrication” amidst sensitive peace negotiations.

Syria has introduced new banknotes, eliminating zeros and portraits in a move to strengthen national identity and restore confidence in the economy.

The United States and Israel do not fully agree on the future of the West Bank, U.S. President Donald Trump said on Monday, without detailing the differences.

The Democratic Republic of Congo’s army has suspended its spokesperson after he made discriminatory remarks targeting the Tutsi minority.

You can download the AnewZ application from Play Store and the App Store.

What is your opinion on this topic?

Leave the first comment