Google AI boss calls for more study of potential AI threats

The chief executive of Google DeepMind, Demis Hassabis, has called for more urgent research into the potential dangers posed by artificial intelligenc...

In May 2025, Türkiye’s annual inflation rate declined to 35.41%, down from 37.86% in April and falling short of the market forecast of 36.1%. This represents the lowest rate recorded since November 2021, as price increases slowed across almost all categories.

According to data from TurkStat, the highest annual price increases were recorded in education (71.67%), housing (67.43%), and health (40.12%).

In contrast, the smallest increases were observed in clothing and footwear (14.12%), communications (19.25%), and transportation (24.59%).

TurkStat also highlighted the three main expenditure categories with the highest weighting in the inflation basket: food and non-alcoholic beverages, which saw an inflation rate of 32.87%; transportation at 24.59%; and housing at 67.43%.

The contributions of these categories to the overall annual inflation were as follows: 8.25% from food and non-alcoholic beverages, 4.07% from transportation, and 9.34% from housing, the agency noted.

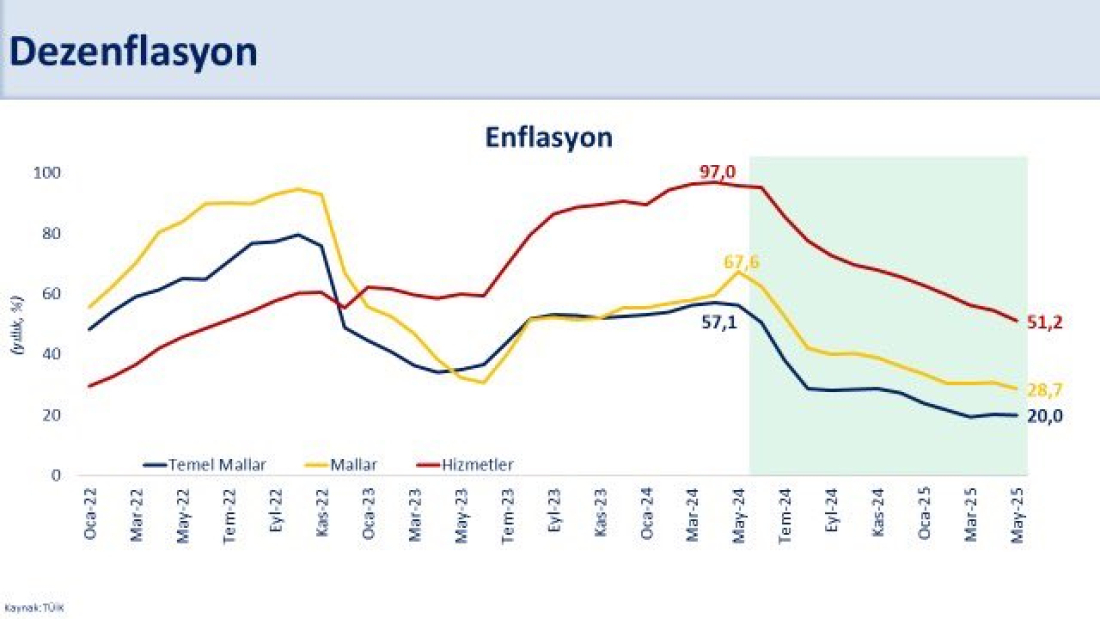

Treasury and Finance Minister Mehmet Şimşek announced on social media platform X that annual inflation in Turkey has dropped by 40% over the past year, falling to 35.4%.

“Goods inflation stood at 28.7%, marking the lowest level in the past three and a half years. With inflation steadily declining and expectations improving, services inflation also dropped significantly—by 45 percentage points year-on-year—to 51.2%, the lowest rate since June 2022,” Şimşek stated.

He added, “Thanks to the determined implementation of our economic policies, ongoing disinflation will lead to greater predictability, improved financing conditions, a more attractive investment climate, and increased productivity. These factors will support sustainable, high-quality growth and enhanced welfare.”

Vice President Cevdet Yılmaz stated that the government remains committed to its economic program in a separate post on X: “Our primary objective is to bring down inflation and ensure stable, healthy economic growth. Despite volatility in the financial markets during March and April, the disinflation trend has continued uninterrupted for 12 months since June 2024, supported by a rebalancing of demand and improved inflation expectations.”

He also noted that the monthly pace of price increases has “slowed down significantly.”

Quentin Griffiths, co-founder of online fashion retailer ASOS, has died in Pattaya, Thailand, after falling from the 17th floor of a condominium on 9 February, Thai police confirmed.

Cubans are increasingly turning to solar power to keep businesses operating and basic household appliances running during prolonged electricity cuts, as fuel shortages make diesel generators and other temporary solutions more difficult and costly to maintain.

Ukraine’s National Paralympic Committee has announced it will boycott the opening ceremony of the Milano Cortina 2026 Paralympics in Verona on 6 March, citing the International Paralympic Committee’s decision to allow some Russian and Belarusian athletes to compete under their national flags.

Eric Dane, the actor best known for his roles in 'Grey’s Anatomy' and 'Euphoria', died on Thursday, at the age of 53 after a battle with amyotrophic lateral sclerosis (ALS). His family confirmed his death after what they described as a “courageous battle” with ALS.

An Austrian climber has been convicted of gross negligent manslaughter after his girlfriend died from hypothermia while climbing Austria’s highest peak, the Grossglockner, in January 2025.

Millions of Colombian roses have arrived in the United States just in time for Valentine’s Day, keeping the country on track as the world’s second-largest flower exporter. Between 15 January and 9 February, Colombia shipped roughly 65,000 tons of fresh-cut blooms.

Russia’s car market is continuing to receive tens of thousands of foreign-brand vehicles via China despite sanctions imposed after Moscow’s full-scale invasion of Ukraine in 2022, a journalistic investigation has found.

Türkiye’s national energy company, TPAO, has struck a new cooperation deal with U.S. energy giant Chevron, signing a memorandum of understanding to explore joint oil and gas exploration and production opportunities, the Turkish Energy and Natural Resources Ministry announced on Thursday.

Wall Street ended sharply lower on Tuesday as investors worried about artificial intelligence (AI) creating more competition for software makers, keeping them on edge ahead of quarterly reports from Alphabet and Amazon later this week.

U.S. stock markets finished mixed on Wednesday (28 January) as investors reacted calmly after the Federal Reserve left interest rates unchanged, a decision that had been widely expected and largely priced in.

You can download the AnewZ application from Play Store and the App Store.

What is your opinion on this topic?

Leave the first comment