Baku court resumes Armenian defendants trial amid peace efforts

The Baku Military Court on Wednesday (5 February) began reading out verdicts in criminal cases against Armenian defendants, with several receiving lif...

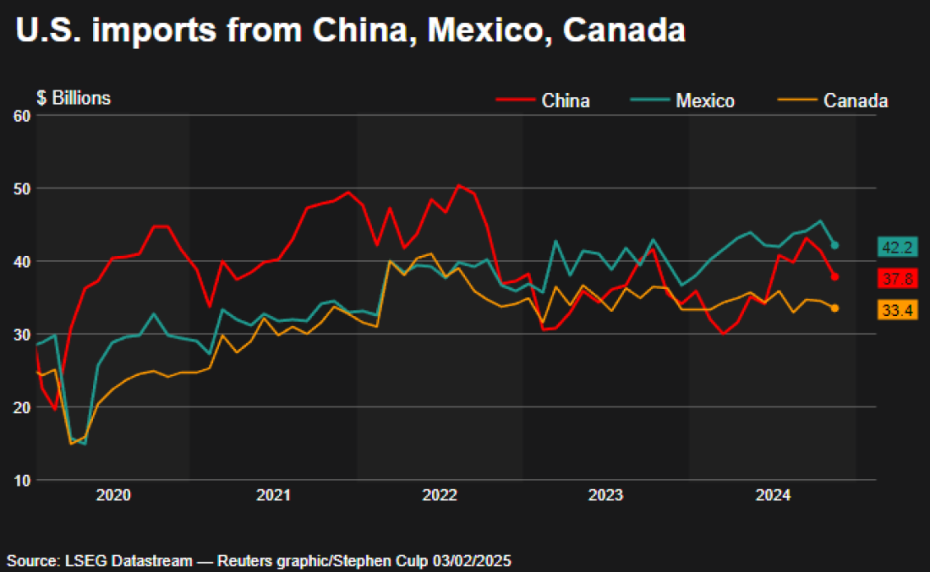

Global markets plunged on Monday as Trump’s tariffs on Canada, Mexico, and China rattled investors, fueling fears of a trade war. A last-minute pause on Mexico’s tariffs helped limit losses, while gold hit a record high and U.S. factory activity returned to growth.

Wall Street drop: The S&P 500 fell 0.38%, while the Dow Jones recovered slightly, closing 0.01% higher.

Tech sector hit: The Nasdaq Composite lost 0.72%, reflecting broader weakness in technology stocks.

Europe’s worst session of 2025: The STOXX 600 plunged 0.87%, while the FTSEurofirst 300 dropped 0.81%.

Asia tumbles: Japan’s Nikkei 225 fell 2.66%, while the MSCI Asia-Pacific index slid 2.04%.

Gold soared to an all-time high of $2,819.50 per ounce, as investors sought safe-haven assets.

Dollar’s mixed performance: After an initial rise, the dollar index fell 0.51%, while the Mexican peso strengthened 1.14% following the tariff pause.

Euro slides: The euro dropped 0.73% to $1.0286, while the Canadian dollar weakened 0.22% against the U.S. dollar.

Crude oil gains: After initial losses, Brent crude rose 0.38% to $75.96 per barrel, while U.S. crude climbed 0.87% to $73.16 per barrel.

₿ Crypto declines: Bitcoin fell 0.91% to $101,215, while Ethereum plunged 17.13% to $2,749.05, extending a broader sell-off in digital assets.

📈 Manufacturing returns to growth: U.S. factory activity expanded for the first time since October 2022, signaling stronger industrial demand.

🔍 Federal Reserve impact: Analysts warn the data may delay rate cuts, as a stronger economy could fuel inflation concerns.

Cuba’s Deputy Foreign Minister Carlos Fernández de Cossío has denied that Havana and Washington have entered formal negotiations, countering recent assertions by U.S. President Donald Trump, while saying the island is open to dialogue under certain conditions.

Rivers and reservoirs across Spain and Portugal were on the verge of overflowing on Wednesday as a new weather front pounded the Iberian peninsula, compounding damage from last week's Storm Kristin.

Morocco has evacuated more than 100,000 people from four provinces after heavy rainfall triggered flash floods across several northern regions, the Interior Ministry said on Wednesday.

Ukrainian President Volodymyr Zelenskyy accused Russia on Tuesday (3 February) of exploiting a U.S.-backed energy ceasefire to stockpile weapons and launch large-scale drone and missile attacks on Ukraine ahead of peace talks.

Paris prosecutors have summoned X chairman Elon Musk and former chief executive Linda Yaccarino for questioning in April as part of their probe into the X social media network, they said on Tuesday.

Wall Street ended sharply lower on Tuesday as investors worried about artificial intelligence (AI) creating more competition for software makers, keeping them on edge ahead of quarterly reports from Alphabet and Amazon later this week.

U.S. stock markets finished mixed on Wednesday (28 January) as investors reacted calmly after the Federal Reserve left interest rates unchanged, a decision that had been widely expected and largely priced in.

The S&P 500 edged to a record closing high on Tuesday, marking its fifth consecutive day of gains, as strong advances in technology stocks offset a sharp selloff in healthcare shares and a mixed batch of corporate earnings.

Chevron is in talks with Iraq’s oil ministry over potential changes to the commercial framework governing the West Qurna 2 oilfield, one of the world’s largest producing assets, after Baghdad nationalised the field earlier this month following U.S. sanctions imposed on Russia’s Lukoil.

Argentina's economic activity shrunk 0.3% in November compared with the same month last year, marking the first monthly contraction of 2025, data from Argentina's national statistics agency showed on Wednesday.

You can download the AnewZ application from Play Store and the App Store.

What is your opinion on this topic?

Leave the first comment