Georgia invites Pope Leo XIV to Tbilisi during PM Kobakhidze's visit

Georgia has formally invited Pope Leo XIV to visit Tbilisi in 2026, following Prime Minister Irakli Kobakhidze’s meeting with the Pontiff at the Vat...

While conventional analysis frames U.S. export controls on China's semiconductor industry as a strategic economic blow, emerging research and market dynamics reveal a more complex and potentially counterproductive reality.

The Escalating Control Regime: A Double-Edged Sword

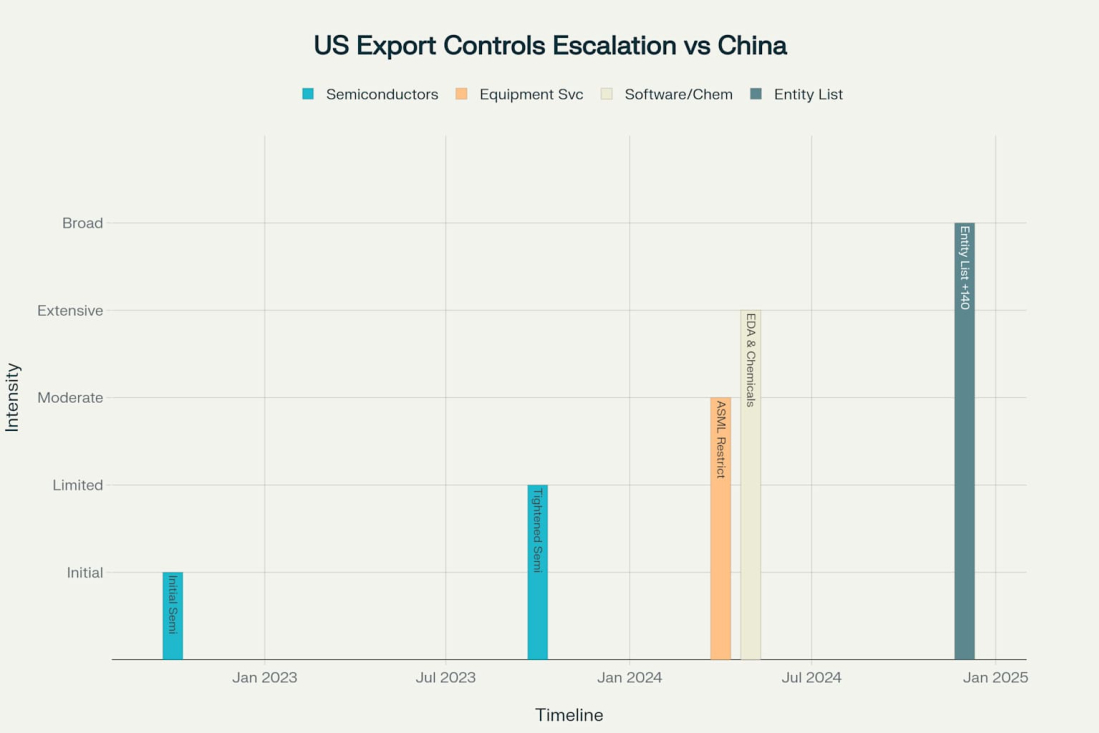

The trajectory of U.S. export controls since October 2022 reveals an increasingly comprehensive yet potentially self-defeating strategy. Beginning with restrictions on advanced AI chips and manufacturing equipment, the controls have expanded to encompass electronic design automation (EDA) software, high-bandwidth memory, and even maintenance services for previously sold equipment. The December 2024 addition of 140 Chinese companies to the Entity List and the May 2025 semiconductor design software restrictions represent the latest escalation in what has become a systematic attempt to impair China's technological capabilities.

However, this escalating approach has generated significant unintended consequences that challenge the fundamental assumptions underlying the policy. Rather than simply constraining Chinese capabilities, the controls have triggered a complex set of responses that may ultimately strengthen China's position in global technology competition.

The Backfire Effect: How Restrictions Fuel Innovation

American Companies Bear the Brunt

Contrary to expectations that export controls would primarily damage Chinese interests, research from the New York Federal Reserve reveals that U.S. firms have suffered a collective loss of $130 billion in market capitalization since the implementation of semiconductor export controls. This financial devastation has cascaded through the American technology sector, resulting in reduced bank lending, lower profitability, and significant job losses. The controls have effectively deprived American companies of the revenue necessary to invest in future innovations and maintain their competitive edge against Chinese rivals.

The impact on specific companies has been particularly severe. Synopsys and Cadence, major EDA software providers, earn approximately 16% and 12% of their annual revenue from Chinese operations respectively. The May 2025 restrictions on semiconductor design software forced these companies to suspend their financial forecasts, illustrating the immediate damage to American technology leadership.

Chinese Innovation Acceleration

Paradoxically, studies examining export controls on dual-use technology from 2007 to 2019 found that Chinese technology manufacturing and assembly firms responded by producing more high-quality innovations. Faced with restrictions on importing cutting-edge technology, Chinese companies have doubled down on research and development efforts, achieving significant strides in technological self-sufficiency.

China's semiconductor industry has demonstrated remarkable resilience and adaptation. Semiconductor Manufacturing International Corporation (SMIC), China's largest contract chipmaker, achieved the second-highest quarterly revenue in its history in Q1 2024, with revenues of CNY 12.594 billion—a 19.7% year-over-year increase. The company has climbed to become the world's second-largest pure-play foundry, trailing only Taiwan Semiconductor Manufacturing Company.

The Self-Reliance Catalyst: Unintended Strategic Acceleration

Massive Domestic Investment Response

Rather than deterring Chinese technological development, U.S. export controls have paradoxically served as a powerful catalyst for Beijing's self-sufficiency drive. The Chinese government has responded with unprecedented investment in domestic capabilities, including more than $400 million raised by eight EDA startups founded in just 24 months. Chinese EDA firms now offer increasingly robust solutions for legacy chips, while domestic equipment manufacturers are positioned to provide strong capabilities for mature node production.

The scale of China's response extends far beyond individual companies. Since 2014, Chinese firms have announced over 110 new fabrication facility projects with a total committed investment of $196 billion. While actual investment has been lower and some projects have failed, 40 new fabs are now operating with an additional 38 production lines under construction.

Technology Bifurcation and Parallel Ecosystems

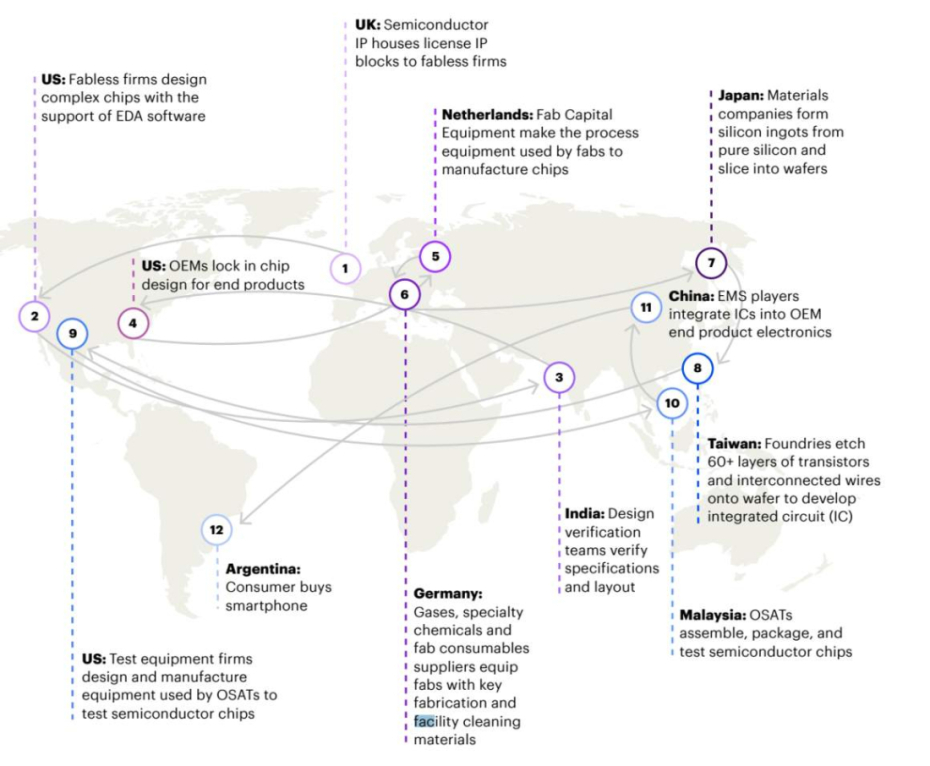

The export controls are inadvertently accelerating the development of parallel technological ecosystems that could fundamentally reshape global technology architecture. China is not merely seeking to replace American technology but is developing alternative standards, protocols, and supply chains that could create lasting fragmentation in global technology markets. This bifurcation threatens to reduce American influence over global technology standards while creating competing centers of innovation.

China's Strategic Counter-Response: The Retaliation Dynamic

Critical Minerals as Leverage

China has responded to U.S. export controls with its own strategic restrictions, particularly targeting critical minerals essential for American technology production. In February 2025, China imposed export controls on tungsten, tellurium, bismuth, molybdenum, and indium—materials crucial for thin-film solar cells, semiconductors, and defense applications. China's dominance in rare earth production, controlling approximately 76.53% of global tellurium output, provides significant leverage in this technological competition.

The Chinese government's April 2025 halt to exports of various essential minerals and magnets has particularly affected supply chains for automakers, aerospace manufacturers, semiconductor firms, and military contractors worldwide. These retaliatory measures demonstrate China's ability to inflict reciprocal damage on American interests while highlighting the interconnected nature of global technology supply chains.

Legal and Regulatory Framework Evolution

China has systematically developed its legal framework for export controls, creating mechanisms that mirror and potentially exceed U.S. capabilities. The December 2024 implementation of new export control regulations on dual-use items provides Chinese authorities with extraterritorial jurisdiction similar to U.S. long-arm provisions. This regulatory evolution enables China to target foreign companies and individuals that support U.S. export control objectives, creating a complex web of competing jurisdictions.

Industry Adaptation and Resilience

Chinese Semiconductor Progress Despite Restrictions

Despite facing the most comprehensive technology restrictions in modern history, Chinese semiconductor companies have achieved notable progress across multiple domains. Chinese fabless firms now hold 16% of the global fabless semiconductor market, ranking third after the United States and Taiwan. These companies are rapidly closing gaps in artificial intelligence chip design, partly due to growing demand from China's hyperscale cloud and consumer smart device markets.

Chinese firms are already designing and producing 7/5-nanometer chips for applications ranging from artificial intelligence to 5G communications. While these achievements fall short of the most advanced nodes produced in Taiwan and South Korea, they represent significant progress toward technological independence in critical areas.

Manufacturing Equipment and Materials Independence

China's push for supply chain independence extends beyond chip design to manufacturing equipment and materials. Domestic Chinese equipment firms are developing capabilities for mature node production, while investments in electronic design automation startups are creating alternatives to American software tools. The Chinese government's procurement and import substitution programs are accelerating adoption of domestic technologies, creating protected markets for indigenous innovation.

The Strategic Miscalculation: Long-term Implications

Technology Leadership at Risk

The export control strategy appears based on the assumption that restricting Chinese access to American technology will maintain U.S. technological leadership indefinitely. However, this approach may be fundamentally flawed, as it underestimates China's capacity for technological adaptation and innovation. By forcing China to develop independent capabilities, the controls may actually accelerate the emergence of a technological competitor with reduced dependence on American innovations.

Academic analysis suggests that while export controls may achieve short-term objectives of slowing Chinese progress in specific advanced nodes, they simultaneously fuel a more determined and heavily resourced long-term effort to build fully indigenous technological capabilities. This could contribute to a more bifurcated global technology landscape with distinct spheres of influence and divergent technological standards.

Alliance Coordination Challenges

The effectiveness of U.S. export controls depends critically on cooperation from allies who control key chokepoints in semiconductor supply chains. However, the existing multilateral export control architecture lacks the flexibility and speed necessary for sophisticated, targeted controls. Countries like the Netherlands, Germany, South Korea, Japan, and Taiwan continue to face difficult decisions about balancing economic interests with strategic alignment.

The recent ethane export control controversy illustrates the potential for poorly designed restrictions to damage relationships with allies while providing minimal strategic benefit. Such missteps undermine confidence in American policy competence and may encourage allies to hedge their bets rather than fully supporting U.S. objectives.

Economic Warfare's Unintended Consequences

Market Disruption and Innovation Incentives

The export control regime has created powerful incentives for technological innovation outside traditional Western frameworks. Chinese companies facing restrictions have been forced to innovate rather than simply adopt existing technologies, potentially leading to breakthrough innovations that could leapfrog current state-of-the-art capabilities. This forced innovation may destabilize existing semiconductor ecosystems and create new competitive dynamics.

The broader implications extend beyond semiconductors to artificial intelligence, renewable energy, and other critical technologies where China is making rapid progress. Export controls that reduce technology transfer may paradoxically accelerate Chinese development of alternative approaches that could eventually compete with or surpass Western technologies.

Financial and Strategic Costs

The financial costs of export controls extend far beyond immediate revenue losses to include reduced innovation capacity, market fragmentation, and strategic vulnerability. American companies deprived of Chinese market access may lack the resources to maintain technological leadership, while China's forced technological development could create new sources of strategic leverage.

The strategic costs include potential loss of influence over global technology standards, reduced ability to shape technological development, and increased risk of technological surprise from Chinese innovations developed outside Western oversight.

Conclusion: Rethinking Technological Competition

Shaw's observation that the United States will likely agree to lift only new export restrictions while maintaining longstanding controls on advanced AI chips reflects a strategic approach that may be fundamentally counterproductive. Rather than representing a "clear blow to China," these controls appear to be accelerating Chinese technological development while imposing significant costs on American companies and strategic interests.

The evidence suggests that export controls, while potentially effective in the short term, may be creating the very technological competitor they were designed to prevent. China's response—massive domestic investment, strategic retaliation, and accelerated innovation—demonstrates the limitations of technology restrictions as tools of strategic competition.

A more effective approach might focus on enhancing American technological capabilities rather than restricting Chinese access to existing technologies. This would require sustained investment in research and development, education, and industrial capacity—areas where export controls provide no benefit and may actually hinder progress by reducing the resources available for innovation.

The current trajectory of escalating export controls risks creating a bifurcated global technology ecosystem that reduces American influence while accelerating Chinese technological independence. Recognizing these unintended consequences is essential for developing more effective strategies for technological competition in an increasingly multipolar world.

The Hayli Gubbi volcano in north-eastern Ethiopia erupted on Sunday for the first time in over 12,000 years, before halting on Monday, according to the Toulouse Volcanic Ash Advisory Center.

Cameras from the United States Geological Survey (USGS) on Saturday (22 November) captured Hawaii's Kilauea volcano spewing flowing lava from its crater in its latest eruption.

Italy captured a remarkable third consecutive Davis Cup title on Sunday, with Matteo Berrettini and Flavio Cobolli securing singles victories in a 2-0 triumph over Spain in Bologna.

U.S. President Donald Trump has told his advisers that he plans to speak directly with Venezuelan President Nicolas Maduro according to Axios, as Washington designated him as the head of a terrorist organisation on Monday. A claim Maduro denies.

Chinese President Xi Jinping has once again expressed strong support for Venezuelan President Nicolás Maduro, condemning foreign interference and criticising U.S. actions in the region.

Chinese President Xi Jinping has once again expressed strong support for Venezuelan President Nicolás Maduro, condemning foreign interference and criticising U.S. actions in the region.

French President Emmanuel Macron has expressed cautious optimism about U.S. President Donald Trump's peace plan for Ukraine, acknowledging its potential but stressing that key aspects need further negotiation to make it acceptable for Ukraine and Europe.

After a call with UK Prime Minister Keir Starmer, Ukrainian President Volodymyr Zelenskyy said Kyiv now sees “many prospects” for peace, pointing to progress made during recent discussions with U.S. officials in Geneva, Switzerland.

The U.N. human rights office has called for an investigation into Israeli airstrikes in Lebanon, which have killed at least 127 civilians since a ceasefire was agreed nearly a year ago.

Kazakhstan plans to build a new seaport in Aktau, the governor of Mangistau region, Nurdaulet Kilybay said at a government meeting, Trend reports.

You can download the AnewZ application from Play Store and the App Store.

What is your opinion on this topic?

Leave the first comment