In a significant escalation of its "maximum pressure" campaign against Iran, the Trump administration is reportedly mulling a plan to stop and inspect Iranian oil tankers at sea.

Sources familiar with the matter told Reuters that the initiative would use an international accord aimed at preventing the spread of weapons of mass destruction to justify the inspections.

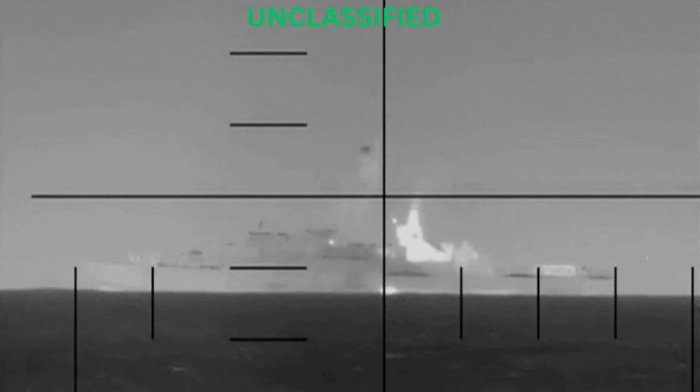

According to the report, the proposed measure would have allied countries intercept ships at key chokepoints—such as the Malacca Strait and other strategic sea lanes—to delay deliveries of Iranian crude. Officials expect that such delays would create a chilling effect on the illicit trade networks that Iran relies on for revenue, without the need to resort to more drastic measures like sinking vessels or arresting crews.

The plan comes as President Donald Trump has vowed to drive Iran's oil exports to zero in a bid to prevent Tehran from obtaining nuclear weapons. Trump’s administration had already imposed two waves of fresh sanctions during the early weeks of his second term, targeting companies and the so-called shadow fleet of aging oil tankers that transport crude from sanctioned countries without Western insurance.

Officials are now exploring whether these at-sea inspections can be conducted under the auspices of the Proliferation Security Initiative (PSI), a mechanism launched in 2003 to disrupt the trafficking of weapons of mass destruction. “It would be fully justified to use the PSI to slow down Iran’s oil exports,” said John Bolton, the former U.S. lead negotiator for the initiative. Bolton added that cutting off Iran’s oil revenue is critical to limiting its ability to finance both proliferation activities and support for terrorism.

The proposed move could potentially reduce Iranian oil exports by roughly 750,000 barrels per day in the short term, according to energy analysts. However, some experts caution that prolonged sanctions may eventually lose their effectiveness as Tehran and its trading partners adapt to new methods of circumventing restrictions. Moreover, a resumption of oil exports from Iraq's semi-autonomous Kurdistan region could help offset any reductions in Iranian supply.

Previous U.S. efforts under the Biden administration to interdict Iranian oil shipments met with mixed results. Earlier attempts led to retaliatory actions by Iran, including the seizure of foreign ships, one of which was chartered by Chevron Corp. These incidents have underscored the delicate balance in enforcing sanctions without provoking further escalation.

The National Security Council is reportedly reviewing the possibility of coordinated inspections at sea, but it remains unclear whether Washington has reached out to any of the over 100 PSI signatories to gauge their willingness to cooperate.

As the Trump administration intensifies its campaign to isolate Iran from the global economy, the proposed plan to disrupt Iranian oil shipments at sea represents its latest effort to leverage international security mechanisms in pursuit of its strategic goals.

What is your opinion on this topic?

Leave the first comment