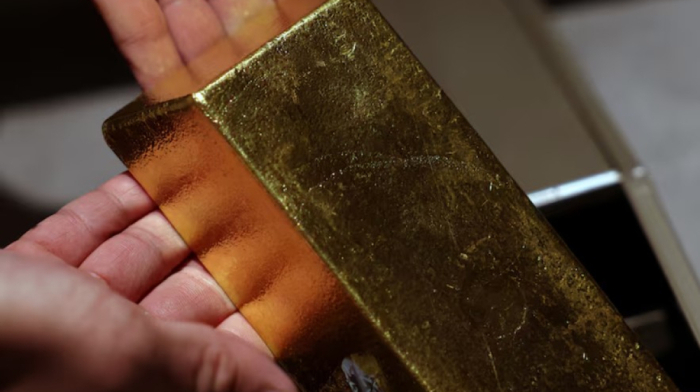

Dozens of public companies, including one founded by Donald Trump, are adding bitcoin to their balance sheets, betting big on crypto amid soaring prices and political backing from the U.S. President.

A growing number of public companies are adopting bitcoin treasury strategies - allocating part of their reserves to the world’s most popular cryptocurrency - in a move reminiscent of MicroStrategy’s headline-making pivot in 2020. According to a report by Standard Chartered, 61 companies not originally focused on digital assets have joined the trend, doubling their bitcoin holdings in just two months.

Among them is Trump Media & Technology Group, which raised $2.5 billion last month specifically for bitcoin investments. The company joins early adopter Strategy (formerly MicroStrategy), now holding over $63 billion in bitcoin and boasting a stock surge of over 3,000% since 2020.

The list of newcomers includes high-profile ventures like Twenty One - a $3.6 billion bitcoin-focused firm backed by SoftBank, Tether, and Cantor Fitzgerald - as well as SolarBank, a Canadian solar energy firm aiming to attract younger investors. Upexi, a consumer goods company, is experimenting with Solana, another top cryptocurrency.

“It is a great way for a company to really bring attention to itself and grow,” said Upexi’s Chief Strategy Officer Brian Rudick, adding that markets appear to reward firms that add crypto to their treasuries.

The surge comes as Donald Trump ramps up support for digital assets, signing an executive order in March to create a U.S. bitcoin reserve and hosting crypto leaders at the White House. Observers like Carnegie Mellon's Chester Spatt say the alignment with Trump’s policy could also be politically motivated.

But there are risks. Analysts warn that firms buying bitcoin at all-time highs risk major losses if prices fall. Standard Chartered estimates that if bitcoin dips below $90,000, half of these corporate crypto treasuries would be underwater. Charles Schwab also cautioned that heavy crypto exposure could spark liquidity crises during downturns.

Still, with bitcoin trading above $110,000 and regulatory winds shifting, companies are betting that now is the time to get in - and get noticed.

Read next

09:26

Iran

Iranian state television on Tuesday called on citizens to delete WhatsApp from their smartphones, claiming without providing specific evidence that the Meta-owned messaging platform was collecting user data to send to Israel.

08:51

As Armenia prepares to host the 8th European Political Community Summit and Baku gets ready for the 12th, Caucasus Now explores a critical question: are external actors truly invested in peace between Armenia and Azerbaijan?

08:25

Texas

Texas has halted new funding for construction of the U.S.-Mexico border wall, a major policy shift after four years of investment in one of Governor Greg Abbott’s flagship immigration initiatives.

08:10

Newshour Guy G7

Our NewsHour presenter Guy Shone examined the geopolitical ripple effects of the escalating conflict between Israel and Iran during the G7 summit, where U.S. President Donald Trump’s early exit drew worldwide attention.

07:42

Australia is set to begin negotiations on a new security and defence partnership with the European Union, while also pushing for a long-anticipated trade agreement, Prime Minister Anthony Albanese announced at the G7 summit.

What is your opinion on this topic?

Leave the first comment