Türkiye’s first electric SUV Togg T10X set to launch in Germany by end of 2025

Türkiye’s first domestically produced electric SUV, the Togg T10X, is expected to hit the German market by the end of 2025, German daily Bild repor...

Spy cockroaches, tank-like AI robots, and battlefield drones are at the heart of Germany’s ambitious plan to reinvent warfare, as Europe ramps up defence spending in response to Russia’s invasion of Ukraine.

For Gundbert Scherf, co-founder of Munich-based Helsing – Europe’s most valuable defence start-up – says the war changed everything.

"Europe this year, for the first time in decades, is spending more on defense technology acquisition than the U.S.," said Scherf, whose company makes military strike drones and battlefield AI.

The former McKinsey & Company partner said Europe may be on the cusp of a defence transformation akin to the Manhattan Project, the World War Two U.S. program that developed nuclear weapons.

"Europe is now coming to terms with defense," Scherf said.

Once struggling to attract investors, Helsing more than doubled its valuation to $12 billion in a fundraising last month.

Europe’s largest economy aims to play a central role in rearming the continent.

Chancellor Friedrich Merz’s government views AI and start-up technology as key to its defence plans and is slashing bureaucracy to connect start-ups directly with the military, the sources said.

Shaped by the trauma of Nazi militarism and decades of pacifism, Germany long maintained a small and cautious defence sector under the protection of U.S. security guarantees.

Its business culture, shaped by a deep aversion to risk, favoured incremental improvements over disruptive innovation.

No longer.

With U.S. military support less certain, Germany – one of Ukraine’s biggest backers – plans to almost triple its regular defence budget to around 162 billion euros ($175 billion) annually by 2029.

Much of that money will go into reinventing warfare.

"We want to help give Europe its spine back," said Scherf.

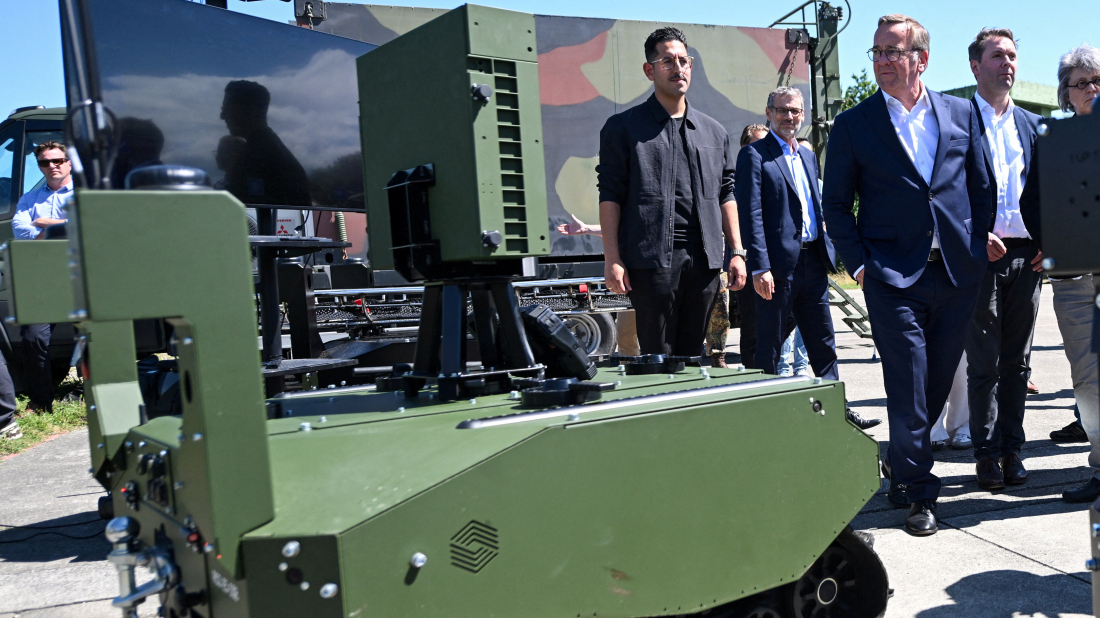

Helsing is part of a wave of German defence start-ups developing cutting-edge technology, from unmanned mini-submarines and tank-like AI robots to battle-ready spy cockroaches.

Some smaller firms are now advising the government alongside established “primes” such as Rheinmetall and Hensoldt, which have less incentive to focus on innovation because of large backlogs for conventional systems, one source said.

A new draft procurement law approved by Merz’s cabinet on Wednesday aims to reduce hurdles for start-ups by enabling advance payments and limiting tenders to bidders inside the European Union.

Marc Wietfeld, CEO of autonomous robots maker ARX Robotics, said a recent meeting with Defence Minister Boris Pistorius underlined how deeply thinking in Berlin has shifted.

"He told me: 'Money is no longer an excuse – it's there now'. That was a turning point," Wietfeld said.

Since Donald Trump’s return to the political stage and his renewed questioning of America’s NATO commitments, Germany has pledged to meet the alliance’s new target of 3.5% of GDP on defence by 2029 – faster than most European allies.

Officials in Berlin stress the need to build a European defence industry rather than rely on U.S. suppliers.

However, challenges remain: Europe’s market is fragmented, with each country operating its own procurement standards, while the U.S. already has established defence giants like Lockheed Martin and RTX, as well as an advantage in satellite technology, fighter jets, and precision-guided munitions.

Washington began boosting defence tech start-ups in 2015, awarding contracts to companies such as Shield AI, drone maker Anduril, and software firm Palantir.

European start-ups, by contrast, received little government support until recently.

An analysis by Aviation Week in May showed Europe’s 19 top defence spenders – including Türkiye and Ukraine – are projected to spend 180.1 billion euros on military procurement this year, compared to 175.6 billion in the United States.

Washington’s overall military spending will remain far higher.

Hans Christoph Atzpodien, head of Germany’s security and defence association BDSV, said the procurement system was still geared toward established suppliers and not adapted to the fast pace new technologies require.

Germany’s defence ministry said it was accelerating procurement and integrating start-ups to make new technologies quickly available to the Bundeswehr.

Annette Lehnigk-Emden, head of the military’s procurement agency, highlighted drones and AI as crucial new fields.

"The changes they're bringing to the battlefield are as revolutionary as the introduction of the machine gun, tank, or airplane," she told.

The war in Ukraine is changing public attitudes towards working in defence, said Sven Weizenegger, head of the Bundeswehr’s Cyber Innovation Hub.

"Germany has developed a whole new openness towards the issue of security since the invasion," he said.

Weizenegger said he now receives 20 to 30 LinkedIn requests daily from people pitching defence technology ideas, compared with just two or three weekly in 2020.

Some ideas resemble science fiction.

Swarm Biotactics, for example, is developing cyborg cockroaches equipped with miniature backpacks carrying cameras and secure communications modules to collect real-time data in hostile environments.

Electrical stimuli would allow humans to control the insects’ movements remotely, enabling surveillance of enemy positions.

"Our bio-robots – based on living insects – are equipped with neural stimulation, sensors, and secure communication modules," said CEO Stefan Wilhelm. "They can be steered individually or operate autonomously in swarms."

In the first half of the 20th century, German scientists pioneered many military technologies that became global standards, from ballistic missiles to jet aircraft and guided weapons.

After Germany’s defeat in World War Two, it was demilitarised and its scientific talent dispersed.

Wernher von Braun, who invented the first ballistic missile for the Nazis, was among hundreds of German scientists sent to the United States, where he later helped NASA develop the rocket that took Apollo spacecraft to the Moon.

Military research has historically driven economic progress, with innovations such as the internet, GPS, semiconductors, and jet engines originating in defence programs.

Now, with Germany’s $4.75 trillion economy hit by high energy prices, falling export demand, and Chinese competition, expanding military research could provide an economic boost.

"We just need to get to this mindset: a strong defense industrial base means a strong economy and innovation on steroids," said Markus Federle, managing partner at defence investment firm Tholus Capital.

European start-ups long struggled to survive the “valley of death” – the early stage when costs are high and sales are low – due to investor caution.

But Russia’s invasion of Ukraine has changed investor appetite.

Europe now boasts three defence start-ups valued at over $1 billion: Helsing, German drone maker Quantum Systems, and Portugal’s Tekever.

"There's a lot of pressure now on Germany being the lead nation of the European defense," said Sven Kruck, Quantum’s chief strategy officer.

Germany has become Ukraine’s second-biggest military backer after the United States.

Orders that once took years to approve are now processed in months, and European start-ups have been able to test their products quickly in the field, several sources said.

Venture capital funding for European defence tech reached $1 billion in 2024, up from $373 million in 2022, and is expected to surge further this year.

"Society has recognized that we have to defend our democracies," said Christian Saller, general partner at HV Capital, an investor in ARX and Quantum Systems.

Dealroom data shows German defence start-ups have raised $1.4 billion in the last five years, more than any other European country.

"Quality of talent in Europe is extremely high, but as a whole, there's no better country, no better talent that we've seen other than in Germany," said Jack Wang, partner at Project A.

Germany’s Mittelstand – the network of small and medium-sized companies that forms the backbone of its economy – is also shifting to defence as the country’s automotive industry weakens, freeing production capacity.

Stefan Thumann, CEO of Bavarian start-up Donaustahl, which makes loitering munitions, said he receives three to five applications daily from automotive workers.

"The startups just need the brains to do the engineering and prototyping," he said. "And the German Mittelstand will be their muscles."

The world’s biggest dance music festival faces an unexpected setback as a fire destroys its main stage, prompting a last-minute response from organisers determined to keep the party alive in Boom, Belgium.

Australian researchers have created a groundbreaking “biological AI” platform that could revolutionise drug discovery by rapidly evolving molecules within mammalian cells.

Australian researchers have pioneered a low-cost and scalable plasma-based method to produce ammonia gas directly from air, offering a green alternative to the traditional fossil fuel-dependent Haber-Bosch process.

A series of earthquakes have struck Guatemala on Tuesday afternoon, leading authorities to advise residents to evacuate from buildings as a precaution against possible aftershocks.

'Superman' continued to dominate the summer box office, pulling in another $57.25 million in its second weekend, as theatres welcome a wave of blockbuster competition following a challenging few years for the film industry.

McDonald's plans to significantly expand its investments in artificial intelligence by 2027, with India expected to play a central role in data governance, engineering, and platform development, a senior executive said on Friday.

U.S. President Donald Trump has sharply criticised Federal Reserve Chair Jerome Powell following the central bank’s decision to keep interest rates unchanged.

Microsoft’s market capitalization surpassed $4 trillion in after-hours trading on Wednesday following a stronger-than-expected earnings report for its fiscal fourth quarter, driven by robust growth in its cloud business.

The European Commission has said it does not view imposing network fees on major technology firms as a practical solution to the ongoing debate over funding the expansion of 5G and broadband infrastructure across the bloc.

Germany’s cabinet has approved a draft 2026 budget on Wednesday featuring record investments and a borrowing level nearly three times higher than last year’s, aiming to strengthen infrastructure and defence while efforts to revive growth.

You can download the AnewZ application from Play Store and the App Store.

What is your opinion on this topic?

Leave the first comment